If you want to get a clear idea of your financial health, one important metric to consider is your net worth. Your net worth is essentially the difference between your assets and liabilities. By understanding your net worth, you can gauge your financial progress and make informed decisions about saving, investing, and spending. In this guide, we will cover everything you need to know about calculating your net worth.

What is net worth?

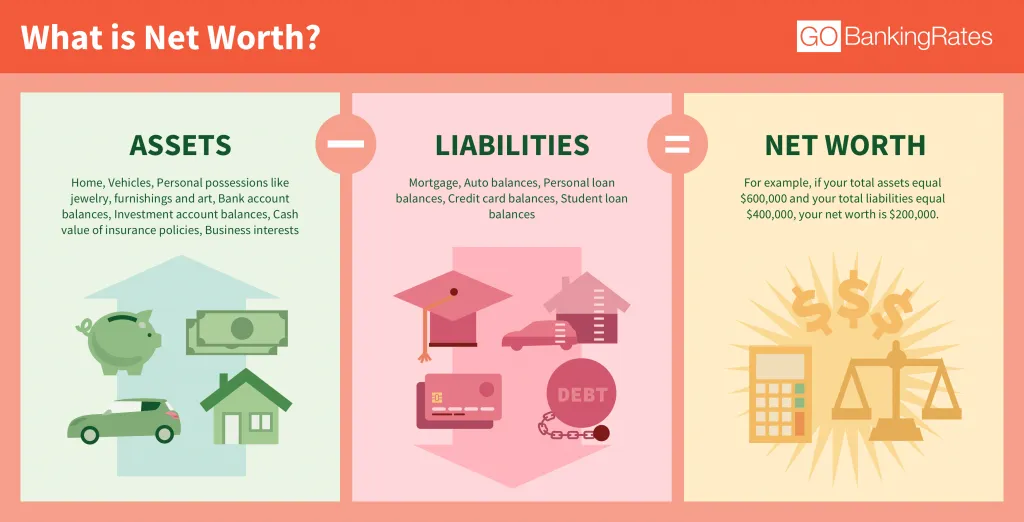

Net worth is the total value of your assets minus the total value of your liabilities. In other words, it is the amount of money you would have left over if you sold all your assets and paid off all your debts. Your assets can include things like cash, investments, property, and personal possessions, while your liabilities can include things like mortgages, credit card debt, and student loans.

Why is net worth important?

Calculating your net worth is important for several reasons. First, it gives you a clear picture of your financial health. If your net worth is positive, it means you have more assets than liabilities and are in a good financial position. On the other hand, if your net worth is negative, it means you have more liabilities than assets and may need to take steps to improve your financial situation.

More About: How Much Is Tesla Worth?

Second, tracking your net worth over time can help you monitor your financial progress. By calculating your net worth periodically, you can see whether you are making progress toward your financial goals or whether you need to adjust your spending, saving, or investing habits.

Finally, understanding your net worth can help you make informed decisions about your finances. For example, if you are considering taking on more debt, knowing your net worth can help you evaluate whether you can afford to take on more financial obligations.

How to calculate your net worth?

Calculating your net worth is a straightforward process that involves adding up the value of your assets and subtracting the value of your liabilities. Here’s how to do it step by step:

List your assets

Start by making a list of all your assets. This can include things like:

- Cash and bank accounts

- Investment accounts (such as retirement accounts, brokerage accounts, and mutual funds)

- Real estate (including your home and any investment properties you own)

- Vehicles

- Personal possessions (such as jewelry, art, and collectibles)

Determine the value of your assets

Next, determine the value of each of your assets. For cash and bank accounts, the value is simply the amount of money you have on hand. For investment accounts, the value is the current market value of the investments. For real estate, the value is the current market value of the property. For vehicles and personal possessions, the value can be more subjective and may require some research to determine.

List your liabilities

Next, make a list of all your liabilities. This can include things like:

- Mortgages.

- Car loans.

- Student loans.

- Credit card debt.

- Personal loans.

Determine the value of your liabilities

For each of your liabilities, determine the total amount you owe. This can usually be found on your monthly statement or by contacting your lender.

Calculate your net worth

Once you have listed all your assets and liabilities and determined their respective values, you can calculate your net worth by subtracting the total value of your liabilities from the total value of your assets. The resulting number is your net worth.

For example, if the total value of your assets is $500,000 and the total value of your liabilities is $200,000, your net worth is $300,000.

Tips for improving your net worth

If your net worth is lower than you would like it to be, there are several steps you can take to improve it:

- Increase your income: Find ways to increase your income, such as asking for a raise or starting a side business.

- Reduce your expenses: Look for ways to cut back on your expenses, such as eating out less or canceling subscriptions you don’t use.

- Pay off debt: Focus on paying off high-interest debt, such as credit card debt, as quickly as possible.

- Invest wisely: Consider investing in assets that have the potential to appreciate in value over time, such as stocks or real estate.

- Monitor your progress: Regularly calculate your net worth to track your progress and adjust your financial plan as needed.

Common mistakes when calculating net worth

There are several common mistakes people make when calculating their net worth, including:

- Overvaluing assets: It’s important to be realistic when valuing your assets, as overvaluing them can lead to an inflated net worth.

- Ignoring liabilities: Make sure to include all your liabilities in your calculations, even if they are small or you don’t think they are important.

- Forgetting to update: Your net worth can change over time as the value of your assets and liabilities fluctuate, so make sure to update your calculations regularly.

Factors that affect your net worth

Several factors can affect your net worth, including:

- Income: Higher income generally leads to a higher net worth.

- Debt: High levels of debt can lower your net worth.

- Investments: Successful investments can increase your net worth, while poor investments can decrease it.

- Real estate: Owning property can increase your net worth, but the value of a real estate can also fluctuate.

Net worth vs. income: what’s the difference?

Net worth and income are often confused, but they are not the same thing. Income is the amount of money you earn in a given period, such as a year, while net worth is the total value of your assets minus your liabilities. While a high income can contribute to a high net worth, it is not the only factor.

How often should you calculate your net worth?

It’s a good idea to calculate your net worth at least once a year, but you can also do it more frequently if you want to track your progress more closely. The more often you calculate your net worth, the easier it will be to make informed decisions about your finances.

Conclusion

Calculating your net worth is an important step in understanding your financial health and making informed decisions about your finances. By following the steps outlined in this guide and monitoring your net worth over time, you can improve your financial situation and work toward your financial goals.

:max_bytes(150000):strip_icc()/net-worth-4192297-1-6e76a5b895f04fa5b6c10b75ed3d576f.jpg)